Gold Doré Bars vs. Bullion: A Comprehensive Analysis

Gold, a symbol of wealth, power, and stability for millennia, takes on different forms as it transitions from raw ore to investment-grade assets. Among these, two stand out: gold doré bars and bullion. While they may appear similar at a glance, they represent vastly different stages in the gold lifecycle and serve different roles within the industry.

Understanding the distinctions between gold doré bars and bullion is essential for professionals across the gold value chain—from mining engineers and refiners to investors and policymakers. This article offers a detailed analysis of these two gold forms, examining their composition, production, uses, economic importance, and environmental impacts. It also explores future trends that may reshape how these forms of gold are produced and used globally.

Gold Doré Bars: The Semi-Refined Output of Mining

Composition and Characteristics

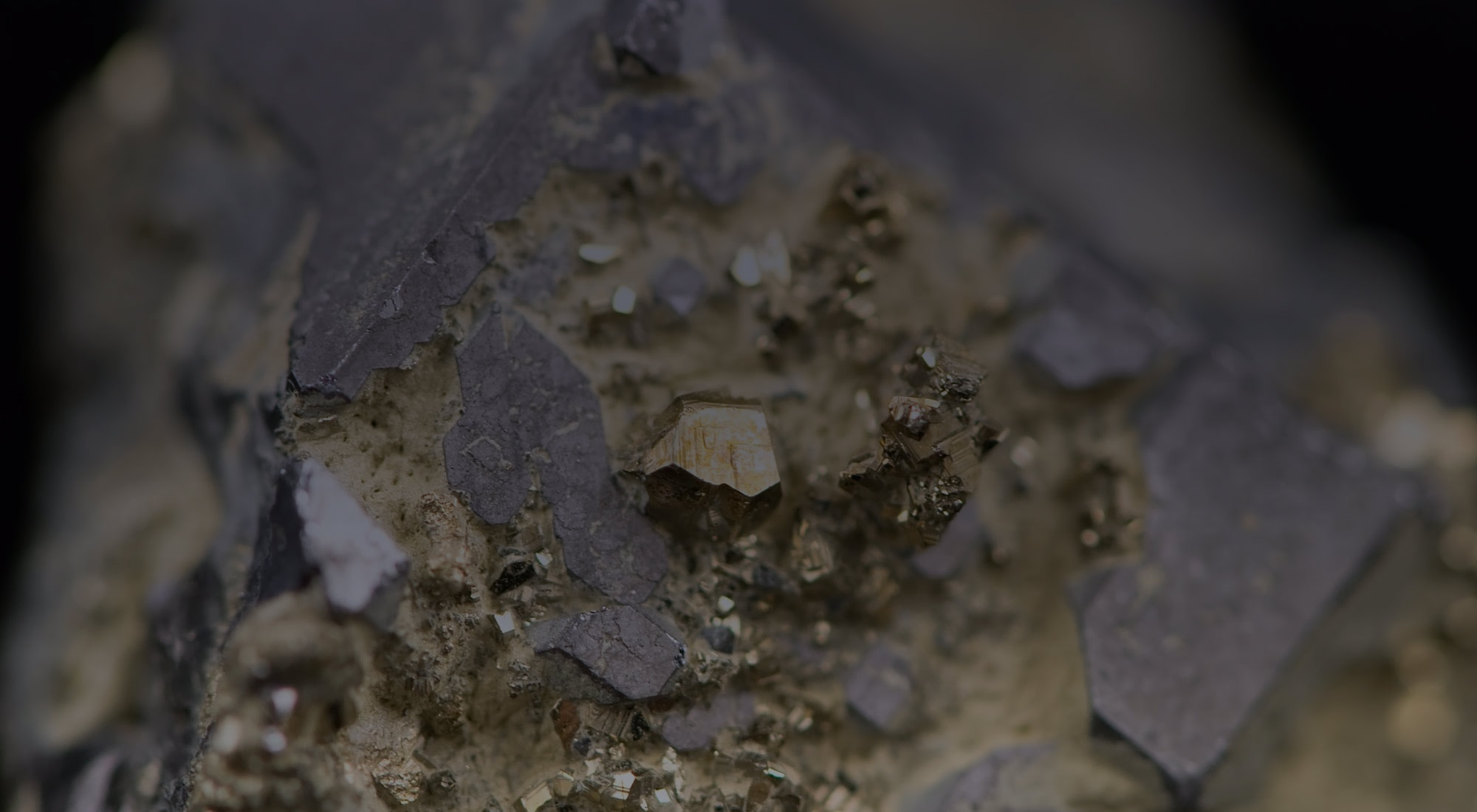

Gold doré bars are the product of initial gold extraction processes. Often produced at or near mining sites, these bars are typically a mixture of gold and silver, with trace amounts of other metals such as copper, lead, zinc, and occasionally platinum group elements (PGEs). The gold content of doré bars usually ranges between 80% and 95%, making them unsuitable for direct commercial or industrial use without further refining.

Because doré bars originate directly from mined ore, their composition reflects the mineralogy of the local geology. For example, in regions with high silver concentrations, doré bars may lean closer to the lower end of the gold purity spectrum. Each bar is stamped with identifying information such as weight, an estimated gold percentage, and the name or mark of the producing company.

Production Process at the Mine Site

The journey of a doré bar begins deep underground or in open-pit mines. Here’s how it’s made:

- Mining and Extraction: Gold-bearing ore is extracted using drilling, blasting, and hauling methods.

- Crushing and Grinding: The ore is processed into fine particles to liberate the gold from surrounding rock.

- Concentration Techniques: Gravity separation, flotation, or cyanide leaching is used to concentrate gold and silver.

- Smelting: The concentrate is then heated in a furnace with fluxes such as silica or borax. Impurities form a slag, which is removed, while molten precious metals settle at the bottom.

- Casting into Bars: The molten metal alloy is poured into molds to form doré bars.

- Cooling and Labeling: Once solidified, the bars are cooled, weighed, and stamped with origin, estimated purity, and batch details.

This process, while efficient at the mine site, leaves a product that still contains enough impurities to require further processing at a specialized refinery.

Economic Role of Doré Bars

Gold doré bars serve a critical economic function in the gold supply chain. They represent the first stage of converting mined ore into a monetizable product. Mining companies use doré bars to:

- Generate revenue by selling them to refineries or metal traders.

- Secure financing or fulfill hedging contracts.

- Establish production metrics for internal performance evaluation.

The value of each doré bar is based on its weight and precious metal content, determined through on-site assays and later confirmed at refineries. This intermediate product also drives demand for services such as assaying, transportation, insurance, and security.

Environmental Considerations

Although the bars themselves are inert, their production is tied to some of the most environmentally intensive activities in the gold industry:

- Land Disruption: Large-scale mining disrupts landscapes and ecosystems through deforestation and soil removal.

- Water Contamination: The use of cyanide and mercury in ore processing poses risks of spills and leaching, contaminating rivers and groundwater.

- Air Quality Issues: Smelting and ore handling release particulates and toxic gases, which affect both workers and nearby communities.

- Waste Generation: The creation of tailings and waste rock often leads to long-term environmental management concerns.

As environmental regulations tighten and stakeholders demand sustainable practices, the environmental impact of doré bar production is under growing scrutiny.

Gold Bullion: The Final Refined Product

Composition, Purity, and Standards

Gold bullion refers to refined gold that meets strict standards for purity and form. Unlike doré bars, bullion is ready for sale in international markets, investment portfolios, and industrial applications. The most common forms of bullion include bars (also known as ingots) and coins.

Bullion is defined by its high purity—typically at least 99.5% (995 fineness), with the highest-purity bars and coins reaching 99.99% or even 99.999%. The gold is often alloyed only slightly, if at all, and is certified by refineries that meet globally recognized standards.

Notable features of bullion include:

- Hallmarks: Refiner’s stamp, weight, and purity.

- Certifications: Most bullion products come with assay certificates or serial numbers to verify authenticity.

- Good Delivery Standards: The London Bullion Market Association (LBMA) sets the benchmark for gold bullion bars used in global trade, requiring specific weights, dimensions, and minimum purity levels.

From Doré to Bullion: The Refining Journey

Transforming doré bars into bullion is a meticulous and highly controlled process conducted at specialized refineries. Common steps include:

- Melting and Sampling: Doré bars are melted to create a uniform composition. Samples are taken to perform precise assays.

- Primary Refining – Miller Process: This involves introducing chlorine gas into molten metal. Non-gold elements react with chlorine and are removed as slag. This yields gold of 99.5% purity.

- Secondary Refining – Wohlwill Process: For 99.99%+ purity, electrolysis is used. Gold anodes are dissolved and redeposited onto cathodes in a solution of hydrochloric acid and gold chloride.

- Chemical Refining: In some cases, aqua regia (a mix of nitric and hydrochloric acid) is used to dissolve gold, which is then precipitated and washed.

- Casting into Bullion: The purified gold is poured into molds of various sizes—from 1 kg bars to 1 oz blanks for coins.

- Certification and Packaging: Each bar or coin is weighed, stamped, and sealed with certificates or tamper-evident packaging for security and traceability.

Economic and Industrial Significance

Gold bullion is more than just a store of value. It serves multiple vital functions:

- Investment: Bullion is a preferred asset for investors during economic volatility. It is held directly or through financial instruments like ETFs, futures, and digital tokens.

- Central Bank Reserves: Countries hold gold bullion in vaults as a hedge against currency risk and a reserve of last resort.

- Jewelry Manufacturing: Refined bullion is alloyed and fabricated into high-value jewelry.

- Electronics and Technology: Gold’s conductivity and resistance to tarnish make it indispensable in circuit boards, aerospace components, and medical devices.

- Currency and Trade: Some sovereign mints issue gold bullion coins as legal tender, helping to maintain confidence in the national currency.

The transparency, traceability, and standardization of bullion make it a cornerstone of the global financial system.

Environmental Impact of Refining

Although less damaging than mining, gold refining does pose environmental concerns:

- Energy Consumption: Smelting and electrolysis are energy-intensive processes.

- Chemical Waste: The use of acids and chlorine must be carefully managed to prevent hazardous waste.

- Air Emissions: Refining can emit vapors and gases, although modern scrubbers reduce their environmental load.

On the positive side, refiners are increasingly incorporating recycled gold into their operations—recovering gold from scrap electronics, old jewelry, and industrial waste. This trend supports the circular economy and reduces the demand for new mining.

Key Differences at a Glance

| Feature | Gold Doré Bars | Gold Bullion |

|---|---|---|

| Purity | 80–95%, variable | 99.5–99.999%, highly consistent |

| Composition | Gold, silver, and base metals | Nearly pure gold |

| Appearance | Rough, unstandardized bars | Precision-cast bars or coins with hallmarks |

| Production Stage | Intermediate (post-smelting) | Final (post-refining) |

| Primary Users | Refineries, traders | Investors, central banks, industries |

| Value Determination | Based on assay and weight | Based on purity, market value, and form |

| Market Eligibility | Not suitable for trading or investment | Traded on global markets |

| Environmental Impact | High (mining-related) | Lower, especially if recycled |

Emerging Trends and the Road Ahead

The gold industry is evolving, and both doré and bullion production are being reshaped by global economic, environmental, and technological forces.

Sustainable and Ethical Gold

Regulatory frameworks and certification schemes such as the Responsible Gold Mining Principles (RGMPs) and the OECD Due Diligence Guidance are pushing miners and refiners toward ethical practices. Consumers and investors increasingly demand gold that is:

- Conflict-free

- Environmentally sustainable

- Traceable from mine to market

Blockchain-based tracking systems are being adopted to provide real-time traceability of gold, ensuring accountability across the supply chain.

Technological Innovation

Advances in refining technology, such as plasma refining and solvent extraction, offer cleaner, more efficient ways to achieve high-purity gold. In mining, sensor-based ore sorting and AI-driven exploration improve ore quality before it even reaches the refinery.

Recycling and Urban Mining

With only limited natural gold resources left, urban mining—recovering gold from waste electronics and obsolete devices—is growing. This reduces the ecological footprint of gold production and supports the transition to a circular economy.

Geopolitical and Macroeconomic Drivers

Gold bullion’s role as a strategic asset remains strong. Central banks are increasing their gold reserves amid global tensions, inflation concerns, and shifts away from the U.S. dollar as the sole reserve currency.

In contrast, the doré bar trade is increasingly influenced by mine nationalization trends, taxation policies, and regional refining capacities, particularly in Africa and South America.

Digitization of Gold Investment

Digital gold platforms now allow investors to buy fractions of bullion securely stored in vaults. Tokenized gold, backed by physical bullion, offers liquidity, transparency, and global accessibility through blockchain networks.

Final Thoughts

Gold doré bars and gold bullion are more than different forms of the same metal—they represent two distinct phases in a complex, global process that transforms raw earth into financial security, technological innovation, and cultural expression.

Doré bars mark the starting point of commercial gold’s journey: rough, valuable, but not yet ready for the market. Bullion, by contrast, is the pinnacle of purity—trusted, traded, and treasured by individuals, institutions, and nations.

Understanding these forms provides not only insight into how gold is processed and valued, but also a deeper appreciation of its environmental cost, its economic role, and its future in an increasingly sustainable and digital world.