Winning Big: The Lucrative World of E-Waste Recycling

1. Introduction

In an era defined by rapid technological advancement and insatiable consumer demand for the latest gadgets, a silent tsunami of electronic waste, or e-waste, is steadily accumulating. From smartphones and laptops to refrigerators and medical devices, the lifespan of electronic products is shrinking, leading to an unprecedented volume of discarded electronics. This mounting global challenge, however, is paradoxically giving rise to a booming industry: e-waste recycling. Far from being mere waste handlers, pioneering companies and innovative startups are transforming what was once considered refuse into a lucrative goldmine, literally.

This article delves into how e-waste recyclers are not just mitigating an environmental crisis but are also winning big by expertly extracting valuable resources, driving economic growth, and championing a more sustainable future.

The sheer scale of the e-waste problem is staggering. The United Nations Global E-waste Monitor reported that 62 million metric tons (Mt) of e-waste were generated globally in 2022, a figure projected to surge to 82 Mt by 2030. This growth outstrips the documented recycling rates, meaning a vast amount of valuable material, along with hazardous substances, is often lost to landfills or informal processing. However, within this challenge lies immense opportunity. E-waste is a complex cocktail of precious metals, rare earth elements, and industrial metals, all of which are in high demand and subject to volatile global prices. For those with the technology and foresight, e-waste isn’t a problem; it’s an untapped urban mine, ripe for profitable refinement. This article will explore the economics driving this industry, the key players, the cutting-edge technologies being deployed, the global trends shaping its landscape, its profound environmental and social impacts, the hurdles it faces, and where this dynamic sector is headed in the coming years.

2. The Economics of E-Waste

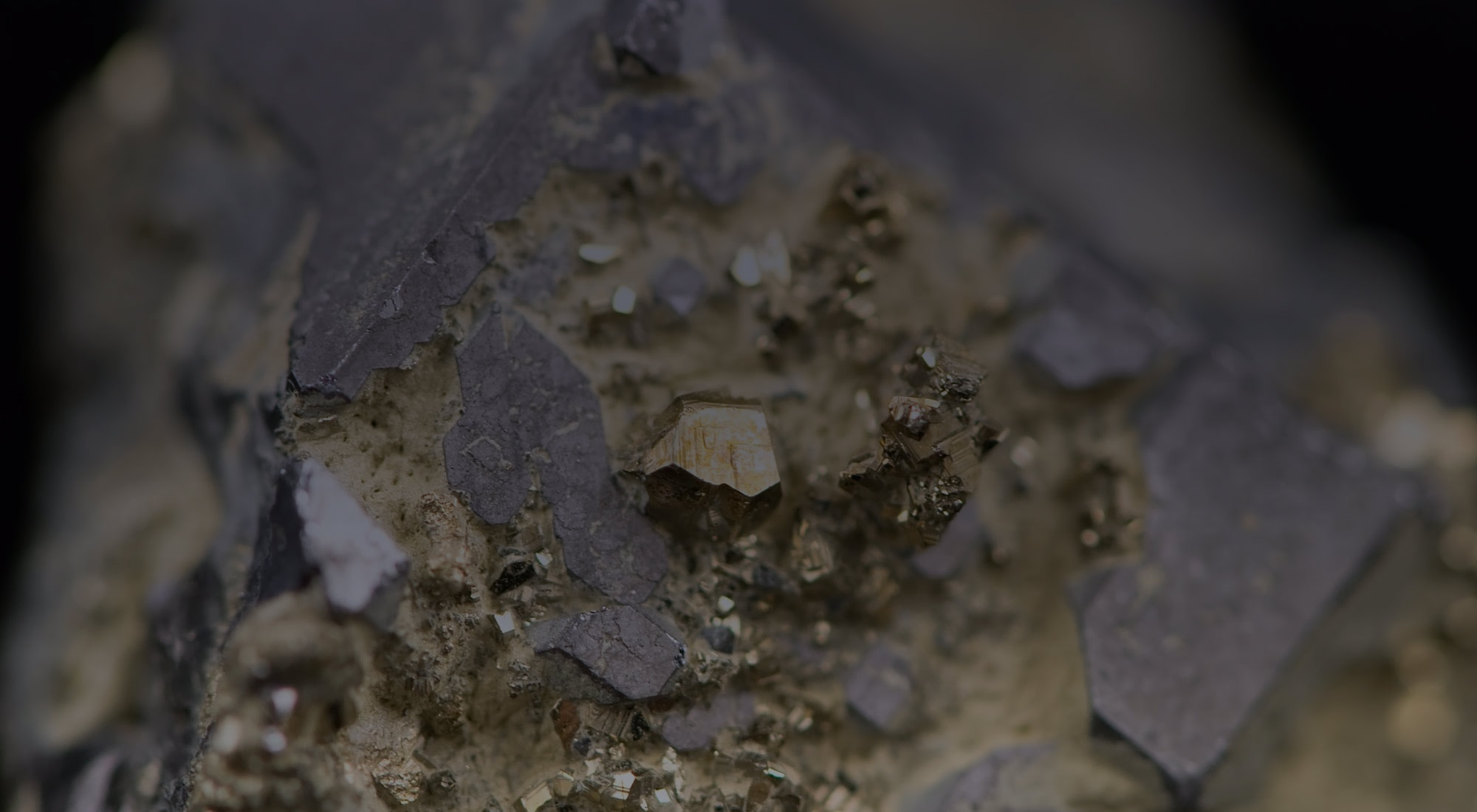

The true genius of e-waste recycling lies in its economic proposition: the extraction of valuable materials embedded within discarded electronics. Unlike traditional mining, which involves costly and environmentally intensive extraction from virgin ore, e-waste recycling offers a more concentrated and often more accessible source of valuable metals. The “urban mine” concept posits that our cities and landfills hold a richer concentration of certain metals than natural geological deposits.

Consider the remarkable bounty hidden within a typical smartphone or circuit board. Gold, silver, palladium, and platinum are present in surprisingly high concentrations, often exceeding those found in natural ore. For instance, a tonne of e-waste from discarded circuit boards can contain 80 times more gold than a tonne of gold ore. Beyond these precious metals, e-waste is a rich source of industrial metals like copper, aluminum, and iron, as well as critical raw materials such as cobalt, nickel, and rare earth elements (neodymium, dysprosium, etc.), which are vital for modern technologies, including electric vehicle batteries and renewable energy systems.

The financial viability of e-waste recycling is further bolstered by the escalating prices of these commodities on the global market. Geopolitical instabilities, supply chain disruptions, and growing demand from emerging technologies are consistently driving up the value of metals. Gold, silver, and copper prices have seen significant appreciation over the past decade, making the efficient recovery of these materials from e-waste increasingly profitable. For recyclers, this means that every tonne of processed e-waste yields a higher return on investment. The economic incentive is clear: refine e-waste efficiently, and the profits can be substantial. This dynamic has shifted the perception of e-waste from a mere disposal problem to a valuable secondary raw material, attracting significant investment and fostering innovation within the industry. The cost advantages are also notable; processing e-waste often requires less energy and water compared to primary metal extraction, contributing to both environmental and economic benefits.

3. Key Players in the Industry

The e-waste recycling landscape is a diverse ecosystem, encompassing established industrial giants, innovative startups, and collaborative partnerships involving technology original equipment manufacturers (OEMs). Each plays a crucial role in advancing the industry’s capabilities and reach.

Among the titans of the industry, Umicore stands out as a global materials technology and recycling group. Based in Belgium, Umicore is a leader in precious metals refining, with state-of-the-art facilities capable of recovering a wide array of valuable metals from complex waste streams, including e-waste and spent catalysts. Their expertise in hydrometallurgical and pyrometallurgical processes allows them to achieve exceptionally high recovery rates, making them a significant player in the circular economy for critical materials.

Sims Lifecycle Services (SLS), a division of Sims Metal Management, is another major global player. SLS provides comprehensive IT asset disposition (ITAD) and e-waste recycling services, focusing on data security, material recovery, and responsible environmental practices. They work with large corporations, data centers, and governments to manage end-of-life electronics securely and efficiently, ensuring maximum value recovery while minimizing environmental impact. Their global footprint allows them to serve a wide range of clients across different continents.

TES (formerly Technology and Electronic Solutions) is a rapidly expanding global leader in IT asset disposition and e-waste recycling. With operations across Europe, Asia, and North America, TES offers end-to-end solutions, from secure data destruction and asset remarketing to material recovery and responsible recycling. Their focus on sustainability and compliance has made them a preferred partner for many multinational corporations seeking to manage their electronic waste streams effectively.

In the United States, ERI (Electronic Recyclers International) is a prominent force, specializing in the recycling of all forms of electronic waste. ERI emphasizes secure data destruction and environmental compliance, boasting a national network of facilities. They are known for their commitment to responsible recycling practices, holding numerous certifications that underscore their dedication to environmental stewardship.

Beyond these established giants, a vibrant ecosystem of innovative startups is disrupting traditional recycling methods. Companies like Redux Recycling GmbH (a joint venture focusing on battery recycling, an increasingly important e-waste segment) are developing specialized processes for high-value components. Other startups are leveraging advanced robotics and AI for automated dismantling, increasing efficiency and safety.

The role of technology partnerships and OEMs is becoming increasingly critical. Major tech companies like Apple and Dell are not just consumers of materials but are also actively investing in and promoting responsible recycling initiatives. Apple, for instance, has developed “Daisy,” a robot capable of disassembling iPhones at an incredible speed, recovering valuable materials for reuse. This demonstrates a growing trend of OEMs taking greater responsibility for the entire lifecycle of their products, driven by both corporate social responsibility and the potential for a stable supply of recycled materials, reducing reliance on volatile primary markets. Dell has also implemented take-back programs and partnered with recyclers to ensure their products are handled responsibly at end-of-life. These collaborations are vital for closing the loop in the electronics supply chain and driving the e-waste recycling industry forward.

4. The Technology Behind E-Waste Refining

The transformation of discarded electronics into valuable raw materials is a sophisticated process, underpinned by a suite of advanced technologies designed for efficiency, high recovery rates, and environmental protection. The journey from a whole electronic device to pure metals involves several intricate stages.

The initial phase typically involves dismantling and pre-processing. This can be done manually for larger items or semi-automatically. The goal is to separate components and materials into basic streams – plastics, metals, circuit boards, batteries, and hazardous materials. Following this, shredding plays a crucial role, reducing complex electronic assemblies into smaller, manageable fragments. Advanced shredders are designed to break down devices while minimizing contamination between material types.

Once shredded, the material undergoes various separation processes. Magnetic separators remove ferrous metals (iron, steel), while eddy current separators are used to separate non-ferrous metals like aluminum and copper. Optical sorting technologies, often enhanced with AI, can identify and separate different types of plastics and even different metal alloys based on color or spectral properties. Water-based separation techniques, such as density separation, are also employed to further refine material streams, leveraging differences in material densities to isolate specific components.

The heart of e-waste refining often lies in smelting and refining processes. For precious metals and some base metals, pyrometallurgy (high-temperature smelting) is a common approach. E-waste feedstock, often concentrated circuit board fractions, is fed into furnaces where metals are melted and separated from other materials. This process can produce crude metal alloys that are then further refined to high purity. Hydrometallurgy, on the other hand, involves using chemical solutions to leach out target metals from the shredded e-waste. This method is often preferred for its lower energy consumption and ability to selectively recover specific metals with high purity, especially critical for rare earth elements. Innovations in hydrometallurgical processes are focusing on developing more environmentally benign lixiviants and closed-loop systems to minimize waste.

A significant leap in efficiency and safety has come with the integration of AI and robotics in automated dismantling. Robots equipped with vision systems can identify different electronic components and precisely dismantle them, far surpassing the speed and consistency of manual labor. This not only accelerates the recycling process but also significantly reduces human exposure to hazardous materials. AI algorithms optimize sorting processes, identify material compositions, and even predict the most efficient dismantling pathways, leading to higher recovery rates and reduced operational costs.

Beyond these core technologies, continuous innovation is focused on non-toxic chemical recovery methods. Traditional chemical stripping processes for precious metals can involve hazardous acids. Researchers and companies are exploring greener alternatives, such as bio-leaching (using microorganisms to extract metals) and supercritical fluid extraction, which utilize non-toxic solvents to recover valuable materials with minimal environmental impact. The development of specialized processes for rare earth elements, which are notoriously difficult to extract, is also a key area of research, as these materials are crucial for future technologies and often have complex chemical properties. These technological advancements are not only boosting profitability but also elevating the environmental credentials of the e-waste recycling industry.

5. Global Trends and Hotspots

The e-waste landscape is globally interconnected, marked by distinct trends and geographical hotspots that shape its collection, processing, and economic dynamics. Certain regions stand out as major generators of e-waste, while others are emerging as processing hubs.

Developed nations are the primary generators of e-waste due to high consumption rates and rapid technological cycles. The United States leads in per capita e-waste generation, driven by its large market for consumer electronics. Europe as a whole is another significant hotspot, with stringent regulations like the WEEE Directive pushing for higher collection and recycling rates. Japan and South Korea in Asia also contribute substantially, given their advanced economies and technologically adept populations. In recent years, China and India have emerged as massive generators of e-waste, not just due to their immense populations but also their rapidly expanding middle classes and increased access to electronic devices. While they are also developing robust domestic recycling infrastructures, the sheer volume poses a considerable challenge.

A critical global trend is the interplay between export and local recycling. Historically, a significant portion of e-waste from developed nations was illegally or informally exported to developing countries, particularly in Asia and Africa. This often led to unregulated and environmentally damaging “backyard” recycling operations, exposing workers to toxic chemicals and polluting local environments. However, increasing awareness, international agreements like the Basel Convention (which restricts the transboundary movement of hazardous wastes), and stricter national regulations are working to curb these illicit flows.

This shift is increasingly favoring local recycling within the generating regions. For instance, the EU’s Waste Electrical and Electronic Equipment (WEEE) Directive mandates that member states collect and recycle a specific percentage of e-waste, driving investment in advanced recycling facilities within Europe. Similarly, in the U.S., various state laws govern e-waste management, often implementing extended producer responsibility (EPR) schemes that hold manufacturers accountable for their products’ end-of-life. These regulations not only promote environmental protection but also foster the growth of legitimate, high-tech recycling industries domestically, contributing to local economies and job creation.

The profitability implications are significant. While informal recycling might seem cheaper, the lack of sophisticated technology means a substantial loss of valuable materials and severe environmental and health costs. Legitimate, high-tech local recycling, while requiring initial investment, offers higher recovery rates of valuable metals, adherence to environmental standards, and the creation of formal sector jobs. As regulatory frameworks strengthen and the value of recovered materials becomes more apparent, the trend towards responsible, localized e-waste processing is gaining momentum globally, turning previous liabilities into economic opportunities.

6. Environmental and Social Impact

The e-waste recycling industry stands at the nexus of environmental stewardship and economic opportunity, delivering significant positive outcomes while simultaneously facing critical challenges related to informal practices.

On the positive side, responsible e-waste recycling yields a multitude of environmental benefits. Foremost among these is waste reduction. By diverting electronic devices from landfills, recycling directly addresses the growing waste crisis and conserves valuable landfill space. This reduction in waste volume also translates to a decrease in the associated environmental burdens of traditional waste disposal, such as methane emissions from decomposing organic matter in landfills.

Furthermore, the industry facilitates significant metal reuse and resource conservation. Every gram of gold, copper, or rare earth element recovered from e-waste reduces the need for primary mining. Traditional mining is an incredibly resource-intensive activity, consuming vast amounts of energy and water, and often leading to extensive land degradation, deforestation, and water pollution. By providing a secondary source of these critical materials, e-waste recycling lessens the environmental footprint of global resource extraction. For example, recovering metals from e-waste typically requires significantly less energy than extracting them from virgin ores – often 2 to 10 times less energy for various metals.

Moreover, proper e-waste recycling plays a crucial role in pollution avoidance. Electronic devices contain a range of hazardous materials, including lead, mercury, cadmium, chromium, and brominated flame retardants. When e-waste is improperly disposed of in landfills or subjected to informal, primitive recycling methods (like open burning or acid leaching), these toxic substances can leach into soil and groundwater, contaminating ecosystems and posing severe health risks to nearby communities. Legitimate recycling facilities are equipped with specialized technologies to safely manage and neutralize these hazardous components, preventing their release into the environment.

However, the industry is not without its dark side, particularly in regions where informal recycling predominates. In many developing countries, the lack of stringent regulations and proper infrastructure has led to a proliferation of informal recycling practices. Workers, often lacking protective gear, dismantle electronics by hand, burn plastic casings to recover copper wires, or use highly corrosive acids to extract gold, releasing a cocktail of toxic fumes and heavy metals into the air, soil, and water. This results in severe hazardous material exposure for workers and surrounding populations, leading to a range of health problems, including respiratory illnesses, neurological damage, birth defects, and cancer. Children are particularly vulnerable, often participating in these dangerous activities.

Despite these risks, the overarching trend is towards embracing the circular economy benefits. E-waste recycling is a prime example of circularity in action, aiming to keep resources in use for as long as possible, extract maximum value from them whilst in use, then recover and regenerate products and materials at the end of each service1 life. This contributes significantly to sustainability tie-ins by reducing reliance on finite virgin resources, minimizing environmental degradation, and fostering a more resilient and sustainable global supply chain for critical materials. The economic incentives for responsible recycling are increasingly aligning with environmental imperatives, driving the industry towards a more responsible and profitable future.

7. Challenges Facing the Industry

Despite its burgeoning profitability and vital environmental role, the e-waste recycling industry confronts a complex array of challenges that threaten to impede its growth and effectiveness. Addressing these hurdles is crucial for the sector to realize its full potential.

One of the most persistent and damaging challenges is illegal dumping and improper recycling. Despite efforts to establish formal recycling channels, a significant portion of e-waste still ends up in general waste streams, incinerated, or illegally exported to countries with lax environmental regulations. This not only represents a loss of valuable materials but also perpetuates the environmental and health hazards associated with informal recycling. The economic incentive for illegal dumping is often lower short-term costs, bypassing legitimate recycling fees and regulations, making enforcement a constant battle.

Collection inefficiencies pose another substantial barrier. Getting people to return old electronics to designated recycling points remains a significant hurdle. Consumers often store old devices at home, are unaware of proper recycling options, or find the process inconvenient. Even with take-back programs and public awareness campaigns, the volume of e-waste collected formally often falls short of the total generated. This “dark flow” of uncollected e-waste means that valuable resources are lost and environmental risks persist. Bridging the gap between generation and collection is critical for feedstock security for recyclers.

Technically, the industry faces considerable difficulties in extracting rare earth elements (REEs). While present in many electronic devices, REEs are typically used in very small quantities and are often integrated into complex alloys or components, making their efficient and cost-effective extraction challenging. The chemical processes required can be complex and expensive, limiting the widespread recovery of these crucial materials. As demand for REEs continues to rise due to their importance in green technologies (e.g., wind turbines, EV motors), developing more efficient and scalable recovery methods is a major R&D focus.

Finally, the volatility in commodity prices introduces a significant element of risk for e-waste recyclers. The profitability of the industry is directly tied to the market value of the metals it recovers. Fluctuations in prices for gold, copper, silver, and other materials can impact profit margins, making long-term financial planning challenging. A sudden downturn in commodity prices can reduce the incentive for recycling and make certain recovery processes less economically viable. This necessitates strong financial management, hedging strategies, and a diversified approach to material recovery to mitigate the impact of market swings. Overcoming these challenges will require a concerted effort from governments, industry players, and consumers alike to ensure a robust and sustainable e-waste recycling ecosystem.

8. The Future: Where Is the Industry Headed?

The e-waste recycling industry is on an undeniable upward trajectory, poised for significant growth and transformation in the coming decades. Projections indicate a substantial increase in market size and influence, driven by technological advancements, evolving policy landscapes, and heightened environmental awareness.

Market growth forecasts are robust. Analysts predict that the global e-waste recycling market will continue to expand at a compound annual growth rate (CAGR) of over 10% in the coming years, potentially reaching tens of billions of dollars by the end of the decade. This growth is fueled by the ever-increasing volume of e-waste generation, coupled with stricter regulations and the rising value of recovered materials. The demand for critical raw materials, driven by the green energy transition and digital transformation, will further underscore the importance and profitability of urban mining.

Emerging business models are set to reshape the industry. Urban mining, the concept of extracting valuable materials from existing infrastructure and waste streams, will become more sophisticated and widespread. This includes not just consumer electronics but also industrial equipment, decommissioned infrastructure, and even older vehicles. Decentralized recycling, where smaller, specialized facilities are located closer to e-waste sources, could also gain traction, reducing logistics costs and increasing efficiency. Furthermore, service-based models, where recyclers offer end-to-end solutions for IT asset disposition (ITAD) and material recovery, are becoming more prevalent, catering to businesses and governments looking for comprehensive, secure, and compliant e-waste management. Product-as-a-service models from manufacturers will also encourage manufacturers to design products for easier dismantling and recycling, further feeding the industry.

The role of policy will continue to be paramount. Governments worldwide are likely to implement even more stringent Extended Producer Responsibility (EPR) schemes, placing greater onus on manufacturers to manage the end-of-life of their products. This will create a steady and growing supply of e-waste for formal recyclers. International cooperation on combating illegal e-waste trade will also strengthen, ensuring that valuable materials are processed responsibly. Incentives for circular design and sustainable production will further align manufacturers’ interests with those of recyclers.

ESG (Environmental, Social, and Governance) investing will also play a crucial role. Investors are increasingly prioritizing companies with strong sustainability credentials, making e-waste recycling an attractive sector for capital deployment. This influx of investment will fund research and development into new technologies, expand processing capacities, and improve collection infrastructure.

Finally, escalating consumer awareness and demand for sustainable products will exert significant pressure on manufacturers to adopt circular practices and on consumers to participate actively in recycling programs. As consumers become more discerning about the environmental impact of their purchases, the brand reputation of companies engaged in responsible e-waste management will be significantly enhanced. The future of e-waste recycling is bright, characterized by innovation, increased investment, and a growing recognition of its indispensable role in building a truly circular and sustainable global economy.

9. Final Thoughts

The sheer volume of electronic waste generated globally presents a monumental environmental challenge, yet within this challenge lies an equally monumental economic opportunity. As explored throughout this article, the e-waste recycling industry has emerged as a powerhouse, transforming discarded gadgets into a trove of valuable resources, from precious metals like gold and silver to critical raw materials essential for our technological future.

The economic imperative is clear: e-waste offers a richer, more accessible, and often more environmentally friendly source of materials compared to traditional mining. Leveraging advanced technologies like AI, robotics, and sophisticated refining processes, leading companies and innovative startups are achieving high recovery rates and significant profits. While challenges such as illegal dumping, collection inefficiencies, and volatile commodity prices persist, the industry is poised for substantial growth, driven by tightening regulations, increasing investment in ESG-aligned businesses, and a rising global consciousness about sustainability.

Ultimately, e-waste recycling is more than just a profitable venture; it is a vital component of a sustainable future. By diverting hazardous materials from landfills, conserving finite natural resources, and reducing the environmental footprint of primary metal extraction, the industry plays an indispensable role in fostering a circular economy. The refiners of e-waste are not just winning big financially; they are also winning big for the planet, demonstrating that economic prosperity and environmental stewardship can, and indeed must, go hand in hand.